Exploring Digital Asset Investing: Highlights from Smart Wealth & 3iQ’s Zurich Event

8 minute readDavid Bogusch

22 October 2024

Event

On October 21st, Zurich’s exclusive Restaurant Königstuhl set the stage for a unique gathering of industry experts to discuss the future of digital asset investing. Hosted by Smart Wealth Asset Management in collaboration with 3iQ, finews.ch and Gentwo, the event provided deep insights into the transformative power of AI-driven investment strategies and the expanding role of digital assets in modern financial markets.

Industry Leaders Share Insights on Digital Asset Trends

The event brought together leading experts to share their perspectives on the future of digital asset investing:

- Miro Mitev, CEO of Smart Wealth, discussed how AI-driven investment strategies can deliver higher returns with lower risk, demonstrating the role of technology in managing volatile markets.

- Pascal St. Jean, CEO of 3iQ, offered a forward-looking approach to digital asset management for institutions, showing how institutional investors can benefit from structured allocation in this asset class.

- Steven Loepfe, Chief Growth Officer at GenTwo, explored the impact of asset tokenization, which expands access to diverse asset classes and broadens investment opportunities.

Moderated by Claude Baumann of finews.ch, the evening’s panel discussion emphasized the growing interest of institutional investors in digital assets. A recent survey by Coinbase and Institutional Investor indicated that over 70% of institutions plan to increase their crypto allocations, marking a strong trend toward mainstream adoption.

Why Digital Assets Are a Compelling Investment

As economic uncertainty reshapes traditional market dynamics, digital assets are emerging as a compelling new frontier for investors. Highlighted at the recent Zurich event, digital assets bring unique countercyclical qualities, enabling them to deliver resilient returns even in turbulent markets. Unlike conventional assets, digital assets offer a diversified risk profile, making them an effective tool for balancing portfolio exposure and enhancing overall performance.

Key Advantages of Digital Asset Integration

According to insights shared from Bloomberg’s Global Market Portfolio (GMP) analysis, the strategic incorporation of digital assets into investment portfolios offers multiple benefits:

- Enhanced Returns: Digital assets have a high growth potential, which can significantly enhance portfolio performance over time, appealing to those seeking both robust returns and innovative asset classes.

- Risk Diversification: With a low correlation to traditional stocks and bonds, digital assets act as an effective hedge, helping mitigate the impact of market volatility on overall portfolio health.

- Yield Generation: Investors gain access to both on-chain and off-chain yield sources, creating a balanced blend of income opportunities and long-term growth potential.

This combination of diversification, enhanced returns, and yield generation positions digital assets as valuable components of a modern investment strategy.

Mission: Solve for Volatility, Harvest Alpha

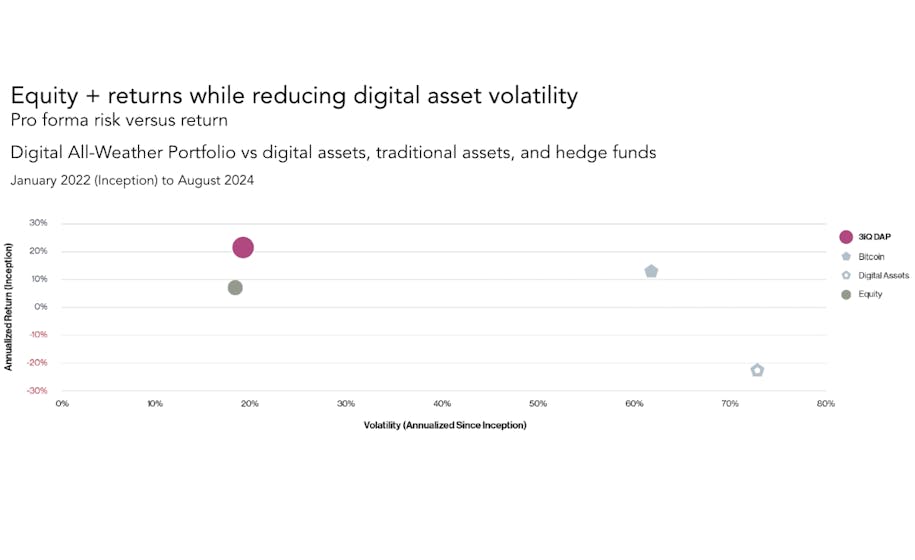

Digital assets hold immense potential, yet their volatility remains a primary challenge for investors. Recognizing this, Smart Wealth and 3iQ are committed to bridging the volatility gap through innovative solutions designed for stability and growth. Their mission, “Solve for Volatility, Harvest Alpha,” encapsulates their approach of mitigating risk while maximizing return potential.

One key innovation introduced at the event was the Smart Wealth Digital All-Weather Portfolio AMC. This strategy offers a unique combination of digital assets and hedge fund strategies, specifically designed to meet the needs of institutional investors looking for a structured entry into digital assets. With the Smart Wealth Digital All-Weather Portfolio AMC, investors benefit from both robust protection and enhanced growth potential, allowing them to explore the promising “alpha” of digital assets without exposure to excessive risk.

Through their partnership, Smart Wealth and 3iQ also launched a specialized portfolio model that leverages this framework. This digital asset portfolio empowers investors to capitalize on the growth potential of digital assets while enjoying the stability typically associated with traditional hedge fund strategies. In today’s market, this approach stands out as an innovative solution, making digital asset investment more accessible and appealing to a broader range of investors.

Introducing the Smart Wealth Digital All-Weather Portfolio AMC

In response to the growing demand for structured digital asset solutions, Smart Wealth and 3iQ have unveiled the Digital Asset All-Weather Actively Managed Certificate (AMC), a sophisticated investment vehicle designed to optimize the balance between return and risk. Presented by Dr. Miró Mitev, CEO of Smart Wealth, the All-Weather AMC utilizes advanced AI and machine learning to navigate various market conditions, offering investors a more consistent and resilient alternative to traditional crypto investments.

Key Features of the All-Weather AMC

- Multi-Strategy Framework: The AMC employs a robust blend of nine strategies, including Long-Biased, Long/Short, Quantitative, and Event-Driven approaches. This multi-strategy structure enables the AMC to adapt to a wide range of market scenarios, enhancing resilience and growth potential.

- AI-Powered Risk Management: Leveraging AI-driven insights, the AMC dynamically adjusts to market conditions, optimizing for returns while keeping volatility in check. This approach helps investors benefit from digital asset opportunities without the typical risk levels.

- Transparency and Flexibility: With a managed account structure, the AMC allows for weekly subscriptions and redemptions, providing flexibility for investors. Its performance-based fee structure further aligns with investors’ interests.

- Consistent Performance in Volatile Markets: The AMC’s focus on absolute returns means it aims to provide stability in even the most volatile market environments, proving to be a resilient option for investors seeking steady gains.

The Role of Digital Assets in Modern Portfolios

As traditional asset classes like stocks and bonds continue to show high correlation, investors are exploring alternatives to diversify their portfolios and reduce risk. Pascal St. Jean, CEO of 3iQ, emphasized at the event the strategic role digital assets can play in achieving these goals. Digital assets bring uncorrelated returns, making them an effective tool for enhancing portfolio resilience and capturing growth in a diversified strategy.

The importance of digital assets in modern portfolios is further underscored by the 2023 Global Market Portfolio report from DWS, which shows digital assets representing an increasing share of diversified portfolios worldwide. While currently only 3.88% of global portfolios include digital assets, the report indicates substantial growth potential as more investors recognize the unique yield and diversification benefits they offer.

By incorporating digital assets, investors can access a broader range of opportunities and create a more balanced portfolio, better suited to withstand market fluctuations and capture alternative growth avenues.

Looking Ahead: Smart Wealth & 3iQ’s Collaborative Future

The Zurich event concluded with a promising outlook on the future of Smart Wealth and 3iQ’s collaboration. Both companies are dedicated to refining and expanding their digital asset solutions to meet the evolving needs of today’s market. This partnership aims to bridge the gap between innovation and institutional standards, combining cutting-edge technology with a commitment to institutional-grade security and infrastructure. Their shared vision includes ongoing research and development to keep investors at the forefront of digital asset advancements. Smart Wealth and 3iQ’s commitment to leading the digital asset space was evident, as they emphasized their mission to provide accessible, resilient, and high-quality digital investment options. This partnership is poised to deliver impactful solutions that align with the demands of an evolving financial landscape. In addition to innovative products, Smart Wealth and 3iQ are dedicated to educating investors and fostering a community of forward-thinking asset managers and investors. If you missed this exclusive event, stay tuned for upcoming sessions that will further explore digital asset strategies and offer invaluable networking opportunities. For more details on the Smart Wealth Digital Asset All-Weather AMC, [visit our product page] and learn how this investment vehicle can enhance your portfolio.

Photo Gallery: Event Highlights

Explore the photo gallery to relive the highlights of this special evening, where thought leaders and investors discussed the future of digital asset management.