Switzerland is globally recognized for its financial innovation and stable investment landscape. Among the most promising financial instruments gaining significant traction are Actively Managed Certificates (AMCs). Below, we explore the primary reasons why investing in AMCs in Switzerland is an attractive and strategic choice for investors.

Investing in Actively Managed Certificates (AMCs) in Switzerland: A Comprehensive Overview

5 minute readPaul Lukas

19 August 2024

Blog

Efficiency and Cost-Effectiveness of AMCs

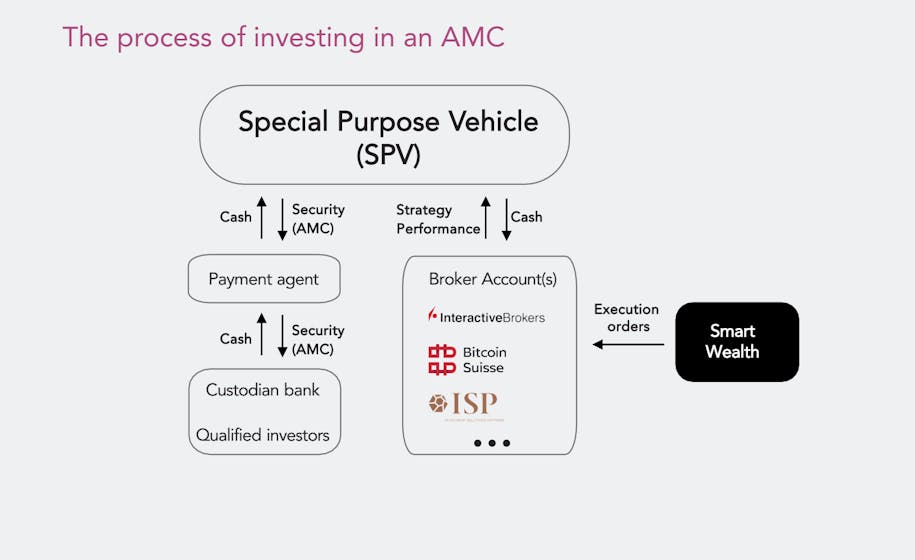

Actively Managed Certificates (AMCs) are engineered to be highly efficient investment vehicles. They allow asset managers to manage entire portfolios with a single instrument, drastically reducing the number of transactions required in a client's custody account. This streamlined process leads to lower operational costs and simpler portfolio management. Unlike traditional AMCs issued by banks, AMCs issued through Special Purpose Vehicles (SPVs) eliminate traditional issuer risk, enhancing safety and appeal for investors.

Flexibility in Investment Opportunities with AMCs

One of the standout features of AMCs is their unparalleled flexibility. AMCs can be used to implement a wide range of investment strategies, covering both liquid assets such as stocks, bonds, commodities, and currencies, as well as non-liquid assets like private equity, real estate, art, private debt, and intellectual property. This flexibility extends to emerging asset classes, including cryptocurrencies, enabling the creation of strategic model portfolios and tactical asset allocations.

The Growing Demand for AMCs

The demand for Actively Managed Certificates has surged, particularly among external asset managers and banks. This increase is driven by several key advantages that AMCs offer over traditional investment funds: Efficiency Gains and Cost Savings: AMCs reduce the number of transactions and associated costs. Scalability: Professional management of multiple client portfolios with consistent treatment and billing is possible. Track Record Building: Asset managers can establish a verifiable performance history. Access to Institutional Instruments: Investors gain access to a broader range of institutional-grade financial instruments.

Process of investing into an AMC

Process of investing into an AMCAdvantages of AMCs Over Traditional Investment Funds

Compared to conventional funds, Actively Managed Certificates provide several distinct benefits: Lower Set-Up and Running Costs: AMCs are cheaper to establish and maintain. Faster Time to Market: AMCs can be launched more quickly. Greater Flexibility in Product Design: AMCs enable more innovative and customized investment solutions. Reduced Seed Money Requirements: The initial capital needed to launch an AMC is significantly lower. Regulatory Efficiency: AMCs are regulated but generally do not fall under the stringent requirements of the Collective Investment Schemes Act (CISA). Tax Efficiency: AMCs are not tax-transparent, and there is no stamp duty on trades within the AMC.

Enhanced Investor Protection and Transparency in AMCs

AMCs in Switzerland are often structured through Special Purpose Vehicles (SPVs), which are segregated from other service providers, including the issuer, payment agent, and custodian. This segregation minimizes traditional issuer risk, providing enhanced investor protection. Additionally, each AMC is issued with an International Securities Identification Number (ISIN), making it a tradable security and adding a layer of transparency and liquidity.

Importance of Jurisdiction in Setting Up SPVs for AMCs

The choice of jurisdiction is crucial when setting up Special Purpose Vehicles (SPVs), as it directly affects the legal, regulatory, and tax environment of the AMC. Certain jurisdictions offer advantages like tax neutrality, political and economic stability, and sophisticated legal frameworks, all of which facilitate smoother operations and enhance the attractiveness of the SPV to investors. Selecting the right jurisdiction is key to meeting the specific needs of the transaction while minimizing risks and costs.

Why Invest in AMCs Managed by Smart Wealth?

Investing in AMCs managed by Smart Wealth offers access to top-tier portfolio management and innovative investment strategies. Smart Wealth ensures that clients' individual investment strategies are encapsulated into their "personal" AMCs, providing bespoke investment solutions with maximum safety, flexibility, and cost-efficiency.