This article will explore the benefits of wealth management using artificial intelligence for investors and explain how this approach differs from traditional investment strategies and investment management. We'll also look at some of the top providers of AI-driven investment management services and discuss how you can get started if you're interested in making this type of investment. So read on to learn more about the exciting world of asset management companies using artificial intelligence!

Revolutionizing Wealth Management - How AI is Transforming the Industry

9 minute read

Embracing the Future: The Journey of Asset Management from Humans to Machine

When it comes to managing their wealth, many investors have unique needs. They require sophisticated investment options and personalized advice that takes into account their specific financial goals and risk tolerance. Traditionally, investors have relied on human advisors and wealth management firms to help them navigate the markets. But with the advent of artificial intelligence (AI), a new option is emerging: AI-driven wealth management.

What are the benefits of AI-driven wealth management?

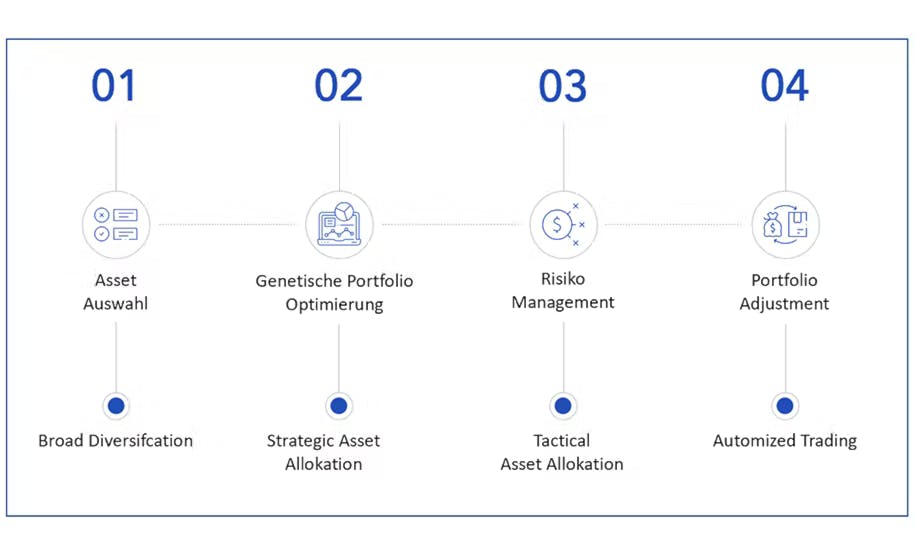

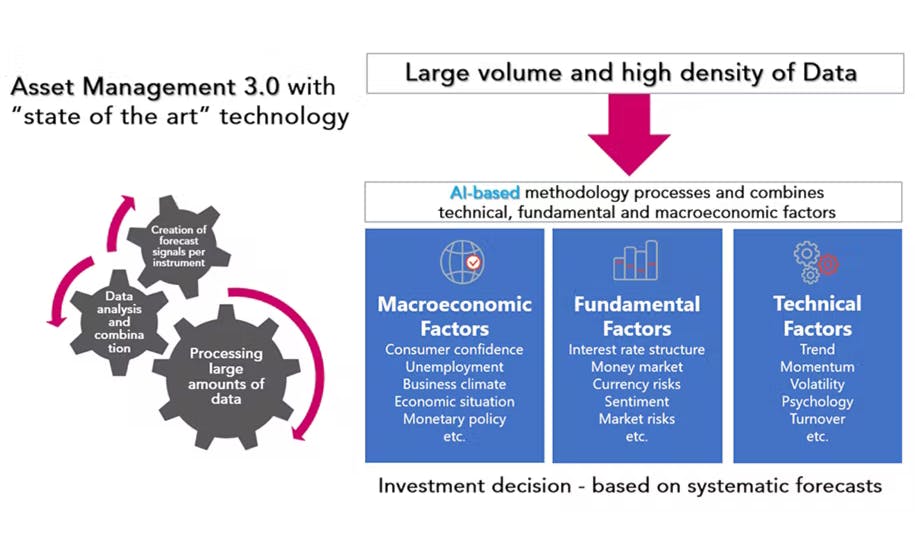

The emergence of artificial intelligence, or AI, has created incredible efficiencies in many industries, but less so in the financial realm. Since AI-driven wealth management is such a new area, it is constantly developing. But in general, AI can be used in wealth management in two main ways: to provide investment recommendations and to automate investment tasks.

When it comes to providing investment recommendations, AI can be used to gather and analyze financial data in order to make predictions about future market trends. This information can then be used to generate investment recommendations that are tailored to each individual client. For example, an AI system might recommend investment opportunities that a client should invest in asset classes, commodities, certain stocks, markets, or sectors if it predicts that this will perform well in the future.

AI can also be used to automate investment management tasks inside portfolio management. This might include tasks such as portfolio rebalancing, trade execution, and risk management. By automating these tasks, AI can help to free up human advisors so that they can focus on better servicing their clients or can rapidly transform business models.

How AI is going to change the game for investors

Overall, AI-driven wealth management has the potential to offer several benefits to many investors. First and foremost, it has the potential to help them make better investment decisions.

These include:

· improved investment performance;

· better risk management; with

· improved risk figures;

· lower fees;

· increased transparency;

· better customer service; and

· easier access to sophisticated investment strategies.

The machine learning wealth management investment industry is still in its early stages, even though Smart Wealth as a pioneer of AI is already working for more than 20 years in that environment and constantly evolving its products offering. Maschine learning asset management is gradually seeping into our world and revolutionizing the business as we know it, with finance being one of the first sectors to experience these changes. In light of this recent progress, many experts are anticipating even more growth and development in AI technology in the years to come.

What are the differences between AI-driven wealth management and traditional asset management?

There are a few key differences between AI-driven asset management and traditional wealth management firms.

Firstly, AI-driven wealth management is much more data-driven than investment management with traditional methods and human beings managers. This means that AI systems can gather and process large amounts of data when enough data are available much more quickly and effectively than humans. This gives them a major advantage and higher success with higher prediction accuracy when it comes to making accurate forecasts about future market trends and market volatility which can enter in better risk management.

Another key difference is that AI-driven wealth management is more personalized. Because machine learning AI systems with analysis of individual clients' data, they can generate and process investment recommendations that are tailored specifically to that person. In contrast, traditional portfolio management with its fundamental analysis, trading strategy, and investment strategy tends to be much more generalized.

Additionally, AI-driven wealth management firms tend to be much more fee-efficient than traditional asset management companies. This is because they often do not need to charge high fees for things like research and performance monitoring, which can inflate the costs of traditional firms.

Finally, implementing AI to manage your investments will allow you to have a more systematic and consistent approach to investing. This will help you to achieve better results on risk and returns and grow your portfolio more efficiently. With AI management, you can rely on sophisticated algorithms to make informed investment decisions based on market trends and data analysis. This will help you to stay ahead of the curve and maximize your return on investment while controlling the downside risk.

Who are some of the most popular providers of AI-driven wealth management services?

Artificial intelligence (AI) has demonstrated a potential impact on the asset and wealth management industry over the past decade. There are several companies and investment firms that offer AI-driven wealth management services. Some of the top providers include:

MAN Group:

One of the world's largest alternative investment and hedge funds managers also quoted the best ai asset management, MAN Group uses AI in AHL to power its flagship product in that business since 2014. The product uses machine learning to generate investment recommendations.

Two Sigma:

One of the world’s most successful quantitative asset managers, dedicated to applying data science and technology-driven solutions to financial markets. Two Sigma has achieved consistent outperformance for its clients through applying advanced analytics techniques such as artificial intelligence, machine learning, and natural language processing to maximize returns.

BlackRock:

One of the world's largest asset managers, BlackRock has been using AI to power its Aladdin platform since 2021. Aladdin uses AI to help clients analyze a broader universe of companies, address their disclosure obligations and build more sustainable portfolios

Bridgewater:

One of the world's largest hedge funds, Bridgewater has been using AI to power its Daily Observations program since 2015. Daily Observations uses AI to help with data analysis and stock selection for Bridgewater's hedge funds.

Morgan Stanley:

One of the world's largest wealth management units, Morgan Stanley developed 2018 a Next Best Action (NBA) system to help financial advisors match investment possibilities to client profiles. The company's chief analytics officer, McMillan, reveals that the system's advanced AI algorithm allows advisors to generate investment offerings much quicker and with greater precision.

What are some of the challenges facing AI-driven wealth management?

There are a few key challenges that need to be addressed for AI technology-driven platforms to be successful.

Firstly, AI systems need to be able to accurately collect and process large amounts of data. This is a challenge because the data analysis that is relevant to investment decision-making can be scattered across different sources, such as news articles, financial reports, and company filings.

Another challenge is that AI systems need to be able to generate accurate predictions about future market trends. This is difficult because the future is inherently unpredictable. AI systems can only be as accurate as the data that they are fed, and even small errors in data can lead to inaccurate predictions.

Very importantly, AI technology-driven asset managers need to be able to explain their predictions to human clients and why they fully benefit from the technology. This is important because most investors ultimately make decisions on their investments, and they need to understand why the AI company is recommending for example selling stocks or buying stocks of a company or industries, in generating a particular course of action.

Finally, AI-driven companies need to be able to generate investment recommendations that are tailored specifically to each individual client. This is a challenge because each person's financial situation is unique, and what works for one person may not work for another.

Conclusion

Despite these challenges, AI-driven asset management systems have the potential to revolutionize the industry by providing investors with more accurate, personalized investment recommendations and risk management. If these systems of most providers can overcome the challenges that they currently face, they will have a major impact on the way that people manage their finances, financial advisory, and investing.

Smart Wealth is a pioneer of AI-driven asset management, and its CEO has been a leading voice in this field for more than 20 years. The routes of Smart Wealth find their origin at FIN4Cast, which was a global leader in the development of quantitative investment strategies not only within Siemens Group. Smart Wealth employs AI to power its suite of systematic investment strategies including its flagship product. Smart Wealth's "iQ-FOXX" is an AI-based portfolio management platform, a powerful tool, that provides users with investment recommendations, and financial advisory and executes tasks such as portfolio rebalancing and trade execution.

At Smart Wealth, we are committed to addressing these challenges and developing innovative solutions that help our clients achieve their financial goals. Smart Wealth’s successful long-term track record has shown our ability to overcome many of the challenges others are still struggling with.

If you are interested in learning more about AI-driven wealth management or want to get started with a portfolio review, please get in touch with us today. We would be happy to answer any of your questions and help you take advantage of this exciting new technology.